Retirement Options

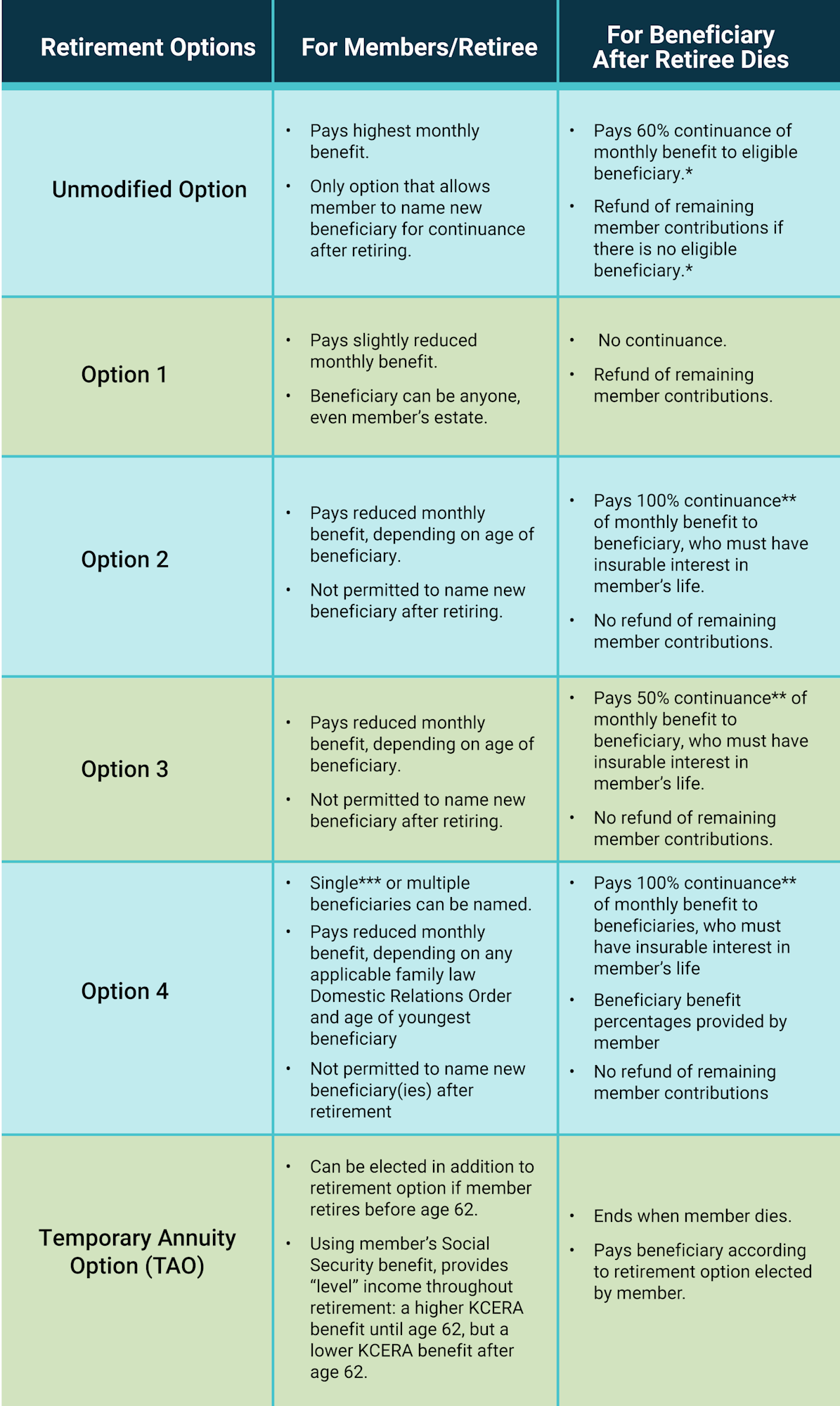

A few weeks after you terminate employment, you will be asked to sign “final papers.” This is when you will officially elect one of five retirement options. Your election will impact your monthly benefit amount and survivorship benefits payable after your death.

Note: This election is irrevocable. It cannot be changed after your first benefit payment is issued. Therefore, it is important to understand the advantages and disadvantages of each retirement option.

Your choice of a retirement option will have a long-term impact on your finances. Therefore, it is important to make a well-informed decision in light of your financial needs and goals. Please contact Member Services staff to discuss your options in greater detail.

* An “eligible beneficiary” is a spouse or registered domestic partner to whom the retiree was married or registered for at least one year prior to retiring or two years prior to death. If the latter, the spouse or partner also must be age 55 or older as of the retiree’s death. If there is no eligible spouse or partner, the member’s unmarried child(ren) under age 18 (up to age 22 if enrolled full-time in an accredited college) can be designated.

** If your designated beneficiary is someone other than a spouse and you are older by an “adjusted age difference” of more than 10 years, the maximum survivor benefit percentage will be reduced based on a table in IRS Regulation 1.401(a)(9)-6.

***Please see KCERA Optional Settlement 4 Policy

The information below is a duplicate of the table above. It is provided for those using screen readers.

Unmodified Option:

For Members/Retiree:

- Pays highest monthly benefit

- Only option that allows member to name new beneficiary for continuance after retiring

For Beneficiary After Retiree Dies:

- Pays 60% continuance of monthly benefit to eligible beneficiary

- Refund of remaining member contributions if there is no eligible beneficiary

Option 1:

For Members/Retiree:

- Pays slightly reduced monthly benefit

- Beneficiary can be anyone, even member’s estate

For Beneficiary After Retiree Dies:

- No continuance

- Refund of remaining member contributions

Option 2:

For Members/Retiree:

- Pays reduced monthly benefit, depending on age of beneficiary

- Not permitted to name new beneficiary after retiring

For Beneficiary After Retiree Dies:

- Pays 100% continuance** of monthly benefit to beneficiary, who must have insurable interest in member’s life

- No refund of remaining member contributions

Option 3:

For Members/Retiree:

- Pays reduced monthly benefit, depending on age of beneficiary

- Not permitted to name new beneficiary after retiring

For Beneficiary After Retiree Dies

- Pays 50% continuance** of monthly benefit to beneficiary, who must have insurable interest in member’s life

- No refund of remaining member contributions

Option 4:

For Members/Retiree:

- Single*** or multiple beneficiaries can be named.

- Pays reduced monthly benefit, depending on any applicable family law Domestic Relations Order and age of youngest beneficiary

- Not permitted to name new beneficiary(ies) after retirement

For Beneficiary After Retiree Dies:

- Pays 100% continuance** of monthly benefit to beneficiaries, who must have insurable interest in member’s life

- Beneficiary benefit percentages provided by member

- No refund of remaining member contributions

***Please see KCERA Optional Settlement 4 Policy

Temporary Annuity (TAO)

For Members/Retiree:

- Can be elected in addition to retirement option if member retires before age 62

- Using member’s Social Security benefit, provides “level” income throughout retirement: a higher KCERA benefit until age 62, but a lower KCERA benefit after

For Beneficiary After Retiree Dies:

- Pays highest monthly benefit

- Only option that allows member to name new beneficiary for continuance after retiring

%20(1)%20(1).png?ixlib=rb-1.1.0&or=0&w=800&h=800&fit=max&auto=format%2Ccompress&s=96c1c61154a293c4575979e95d6e0265)